Export GSTR 3B Data in Excel Format

The process to export GSTR 3B data in SwilERP Software

What is GSTR-3B?

The GSTR-3B is a consolidated summary return of inward and outward suppliers that the government of India has introduced to relax the requirements for businesses that have recently transitioned to GST.

Since many small and medium businesses have been using manual accounting methods, filing returns within the July 2017 deadlines would be difficult for many of these businesses. Hence, from July 2017 to June 2018, tax payments will be based on a simple return called the GSTR-3B.

Note:- Every person who is registered under GST must file GSTR-3B.

When to file GSTR-3B?

Starting 1st Jan 2021, small taxpayers with an aggregate turnover of less than five corers can file quarterly GSTR 3B. Tax liability will auto-populate from GSTR 3b to GSTR 2 while filing returns.

Things to be noted:-

1) Before starting the process, ensure you have downloaded the latest version of SwilERP. (For this, you can contact your local service provider or make a ticket on: Support.swildesk.com

2) To download government offline tool please click the link given below:

Reference link: https://www.gst.gov.in/

Follow the below procedure for exporting GSTR 3B into Excel format:

- Start with Login in the SwilERP dashboard to initiate the process:

- Go to the GST tab.

- GST Forms (For Offline Tool) > Export GSTR 3B (Excel).

Reference Window:

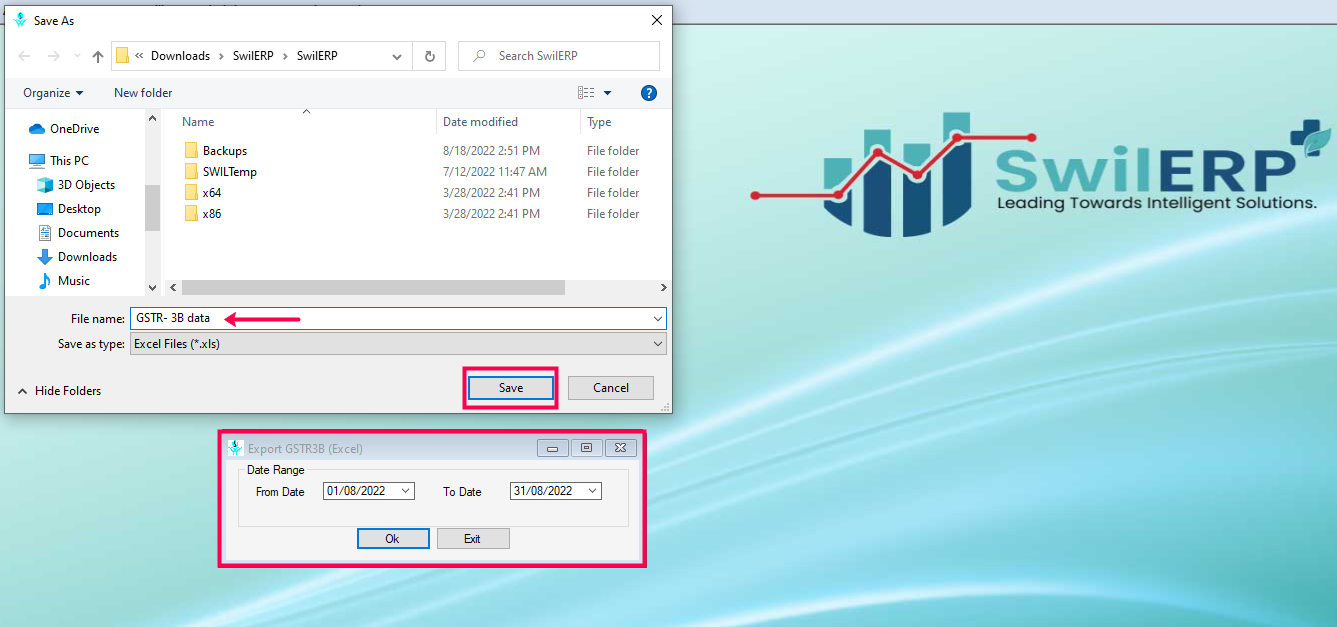

Follow the below-given steps to transform data into excel format:

- Select the Date Range 'From to To'. (For instance, you selected the 1st Aug to 31st August date range)

- Next, click on "Ok".

- After clicking on the "Ok" button, a new window will appear. Please select the file path and, enter the file name, then Save it.

Reference Window:

SwilERP Dashboard Window

SwilERP Dashboard Window

- After saving the file destination, an excel file will open in your system.

- You can check the details on the Excel sheet before uploading it into Offline Utility.

Reference Window:

|

|

Related Articles

Export GSTR-3B Data in Excel Layout

What is the process of exporting GSTR 3B data into excel in SwilERP (RetailGraph) What is GSTR-3B? The GSTR-3B is a consolidated summary return of inward and outward suppliers that the government of India has introduced to relax the requirements for ...Export GSTR9 Data In Excel File

How to Export GSTR-9 Data in Excel File Through SwilERP Software What is GSTR 9? GSTR-9 is the annual return that all registered, taxable people must file. Businesses are required to file this return annually by 31st December of the coming financial ...Export GSTR-2 Excel File

How to Export GSTR2 Excel File Through SwilERP Software What is GSTR-2? The GSTR-2 is a monthly tax return showing the purchases you’ve made for that month. When you make purchases from registered vendors, the information from their sales returns ...Generate and Export Tran-2 Data in Excel

How to Generate and Export Tran-2 Data in Excel in SwilERP What is Tran-2 Data? Form TRAN – 2 can be filed by a dealer/trader who has registered for GST but was unregistered under the old regime. Such a dealer who does not have a VAT or excise ...Export GSTR-1(Excel) Data

How to Export GSTR-1(Excel) Data in SwilERP Software What is GSTR-1 Data ? Form GSTR-1 is a return statement in which a regular dealer needs to capture all the outward supplies made during the month or quarter. In simple words, GSTR-1 is a return in ...